Should We Make an Offer? How We Evaluate Multi-Unit Properties

Recently, we had the chance to evaluate a property in one of Chicago’s suburbs. It’s a great rental market with increasing demand and rising rent prices. We're quite familiar with the area since one of our properties is just about a mile away. The neighborhood buzzes with commercial energy, featuring an Amazon Distribution Center and all the usual Big Box stores. Plus, it’s conveniently close to O’Hare Airport.

When analyzing potential deals, we always keep our ultimate goal in mind: achieving financial independence through multi-family property investment.

To achieve this goal, we have specific criteria for evaluating the potential of a property, primarily in three key metrics:

1. Cash flow

2. Appreciation upon stabilization

3. Cash-on-cash return

Note that these metrics are based on the current market conditions, and we may adapt accordingly.

Definitions:

Cash flow: The difference between total income and total expenses, including mortgage payments.

Appreciation upon stabilization: The ratio of the potential value of the property to the purchase price. Stabilization means the property is performing well, without significant fluctuations in occupancy or income. This often involves making necessary improvements, enhancing property management practices, and ensuring that the property is attractive to tenants.

Cash-on-cash return: The ratio between cash flow and cash-to-close, which includes the down payment and closing costs.

How We Perform Our Evaluations

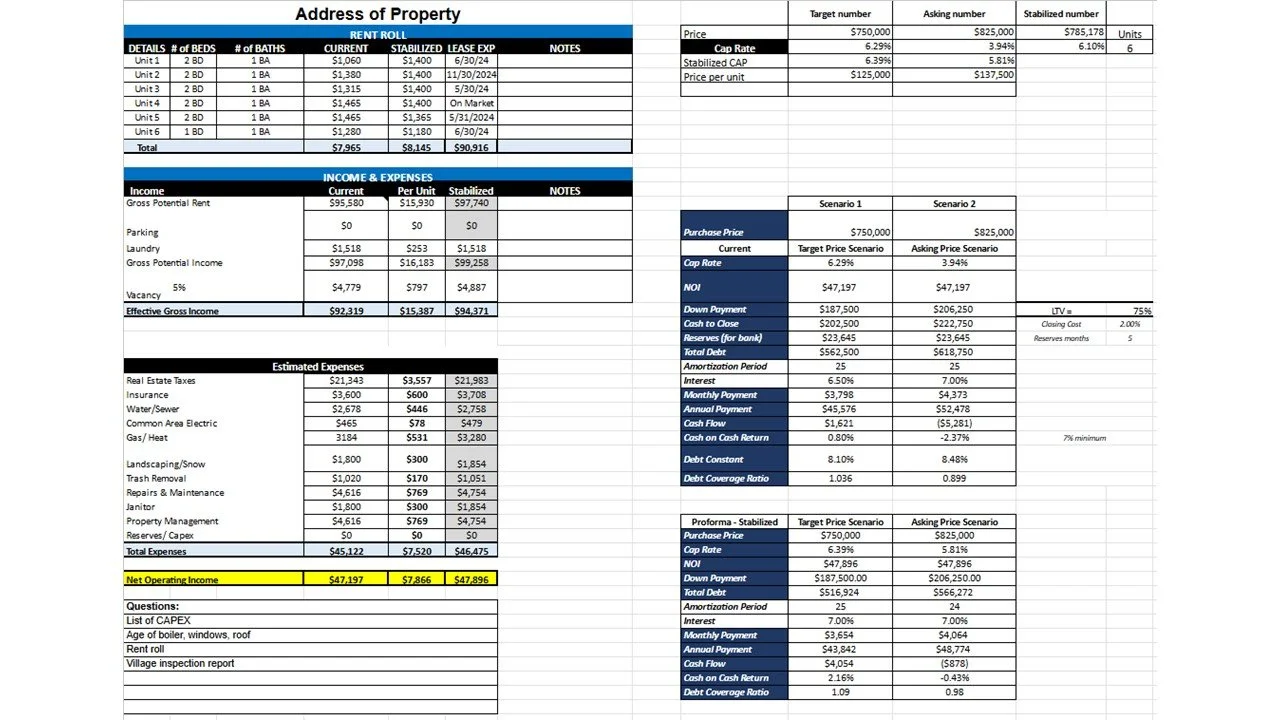

We use a template where we plug in the data. This template has three main sections (plus one additional section):

1. Rental Income: Captures information on rental income and opportunities for miscellaneous revenue from onsite washer/dryer and parking fees.

2. Expenses: Tabulates expenses including utilities, property taxes, property management, repair and maintenance, janitorial, etc.

3. Purchase Price Scenarios: Examines the impact of different purchase prices on metrics like mortgage, debt coverage ratio, cap rate, cash-on-cash return, and cash flow.

The “plus one additional” section captures questions about the property, such as the age of windows and roof, value-add projects performed, and any village violations.

We use this template in our multi-unit property evalution

Let's walk through each section:

Rent Roll Revenue

This section captures the current rent tenants are paying and the expiration dates of their leases. Our template also includes what the stabilized market rent could be, along with potential revenue from parking fees and laundry machines. It's prudent to include a vacancy amount to account for inevitable rental gaps, especially during tenant turnovers.

Estimated Expenses

While expenses may be provided by the listing agent, we always do our own research to make necessary adjustments. For instance, we validate real estate taxes on county tax portals and use similar quotes we've received for insurance and scavenger costs. For property management and repairs/maintenance, we use a range of 5-8%, depending on the amount of deferred maintenance.

The difference between these sections results in the Net Operating Income (NOI), a key metric in our evaluation.

(See the blog on basic concepts for an explanation of NOI and more.)

Scenarios: What If...

As Key Player often quips, “You make money when you buy.” It's a wise mantra to avoid overpaying, as our goal is to buy with enough equity to absorb any unexpected shocks or unforeseen volatility.

The asking price for this property was over $800,000. Based on our experience, we plugged in that amount and a lower amount to examine the key metrics, including cash flow and cash-on-cash return.

Using $750,000 as the lower amount, the annual cash flow was $1,621, or $22.5 per door per month. With a cash-on-cash return under 1%, both metrics didn't meet our criteria based on the current rent.

But what happens when the property is stabilized? Even purchasing it at $750,000 and increasing the rent to a stabilized amount only boosted the annual cash flow to $4,054 (or $62.6 per door per month) and a cash-on-cash return of 2.16%. Both metrics still didn't meet our minimum criteria.

We could use a lower number than $750,000 and continue evaluating to make an offer that meets our criteria.

Epilogue: Did We Make an Offer?

We didn't even get a chance to make an offer. The property was purchased at a higher-than-asking price, which we've seen often lately due to low inventory.

Feel free to contact us if you’d like a copy of our template. Also, we’d love to hear how you make your evaluations. What advice do you have for those pursuing multi-unit property investments?